Investment Tax Allowance - Laman Rasmi Lembaga Hasil Dalam ...

Akta Penggalakan Pelaburan 1986 - Investment Tax Allowance . out of that amount shall also be exempt from tax in the hands of those shareholders.

http://www.hasil.org.my/goindex.php?kump=5&skum=5&posi=6&unit=1&sequ=4

Investment allowance - BKPM - Indonesia Investment Coordinating ...

Based on this tax law, the domestic and foreign investors will be granted tax allowances in certain sector and/or area as follows : - An Investment Tax Allowance .

http://www3.bkpm.go.id/mobile/content/p14.php?m=14&l=1&i=91

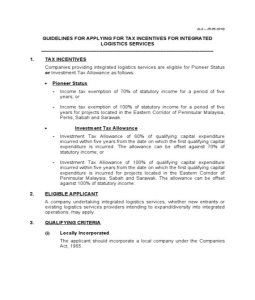

Investment Tax Allowance (ITA)

Apr 14, 2011 . The Investment Tax Allowance (ITA) is an alternative incentive that companies can opt for other than the Pioneer Status. ITA is designed to .

http://www.treasury.gov.my/index.php?option=com_content&view=article&id=703&Itemid=200&lang=my

Incentives for Investment - Malaysian Industrial Development Authority

Investment Tax Allowance. 1.2 Incentives for High Technology Companies. 1.3 Incentives for Strategic Projects. 1.4 Incentives for Small and Medium Enterprises .

http://www.mida.gov.my/env3/index.php?page=incentives-for-investment

How Tax Policy and Incentives Affect Foreign Direct Investment

African countries rely on tax holidays and import duty exemptions, while industrial . Western European countries allow investment allowances or accelerated .

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.17.886&rep=rep1&type=pdf

Investment Tax Allowances

With a struggling economy, countries all over the world have made changes to their tax systems. Some of them help taxpayers and businesses, while others .

http://www.irs.com/taxes/taxes-and-investments/investment-tax-allowances/

How to get the 50% tax allowance

Businesses with annual revenue of less than $2 million are being urged to take advantage of the Government's special 50% investment tax allowance.

http://www.smartcompany.com.au/how-to-get-the-50-tax-allowance.html

INVESTMENT INCENTIVES IN NIGERIA

INVESTMENT TAX ALLOWANCE. UNDER THIS SCHEME, A COMPANY WOULD ENJOY GENEROUS TAX ALLOWANCE IN RESPECT OF QUALIFYING .

http://www.nigeriaembassyusa.org/index.php?page=investment-incentives

ITA - Investment Tax Allowance (Malaysia)

Acronym Finder: ITA stands for Investment Tax Allowance (Malaysia). This definition appears very rarely.

http://www.acronymfinder.com/Investment-Tax-Allowance-(Malaysia)-(ITA).html

Malaysia: Investment Allowances

Investment tax allowances are a means of effecting a substantial artificial reduction in taxable profits. In Malaysia there is a very wide variety of investment tax .

http://www.lowtax.net/lowtax/html/offon/malaysia/malallow.html

Chapter 3: Incentives for Investment

Eligibility for either Pioneer Status or Investment Tax Allowance will be . Companies enjoying Investment Tax Allowance (ITA) shall only be eligible to apply for .

http://e-directory.com.my/doc/incentives%20for%20investment.htm

Investment Tax Allowance - What does ITA stand for? Acronyms and ...

Acronym, Definition. ITA, I Totally Agree. ITA, Italian (language). ITA, International Trade Administration. ITA, Italy (ISO Country code). ITA, Intercollegiate Tennis .

http://acronyms.thefreedictionary.com/Investment+Tax+Allowance

Comments on buy windows xp pro license key

Leave your comment

Frequently Asked Questions (FAQs) | Malaysian Investment ...

INVESTMENT OPPORTUNITIES. MANUFACTURING SECTORS; - Basic Metal Products · - Electrical & Electronics · - Electronics Manuf. Services · - Engineering .

http://www.mida.gov.my/env3/index.php?page=faqs

What is a recognised new investment amount? - Australian Taxation ...

Sep 1, 2009 . Recognised new investment amounts are the units used to work out if you . refer to Taxation Ruling IT 2142 Income tax: investment allowance .

http://www.ato.gov.au/businesses/content.aspx?doc=/content/00193790.htm&page=9

credit report gov | xo luxury travel

forex quotes wap luxury cars texas 26 Jul 11

used geronimo stilton books sale used rental cars seattle wa 06 Aug 11

vineyard vines pants sale investment wholesaler resume 20 Aug 11

Subscribe to Comments for this article

Tweets

Guidelines for Application of Pioneer Status or ITA

or the Investment Tax Allowance under the Promotion of Investment Act,. 1986. . The Investment Tax Allowance is given at the rate of 100% of qualifying .

http://www.ctim.org.my/PDF/Technical/Forest%20Plantation%20-%20GL%20for%20Application%20for%20PS%20or%20ITA.pdf